4LR44 battery are caught in a dispute over multiple technical paths

On the road to 4LR44 battery, the dispute over technical paths has always been inseparable.

There are multiple technical routes coexisting in the positive electrode materials of 4LR44 battery for electric vehicles in China, such as lithium iron phosphate, ternary materials, and lithium manganese oxide. The industry is arguing about the above technical routes.

Through interviews, reporters from the "Daily Economic News" found that behind the coexistence of multiple technical routes, although there are historical factors in the development of lithium battery positive electrode material technology, it also reflects the lack of research on potential customer needs by new energy vehicle manufacturers and lithium battery supporting enterprises and the vagueness of the future positioning of their own products.

The dispute over technical paths has re-emerged/

A qualified lithium battery is basically composed of a shell, positive electrode material, negative electrode material, diaphragm, electrolyte, etc.

Among them, the positive electrode material plays a decisive role in the energy density, safety, cycle life, etc. of 4LR44 battery, accounting for 40% of the cost of 4LR44 battery, and its technical development is particularly critical.

At present, the mainstream positive electrode materials include lithium cobalt oxide, lithium manganese oxide, lithium iron phosphate and ternary materials (mainly including nickel cobalt manganese oxide and nickel cobalt aluminum oxide). In terms of energy density, cost, safety, thermal stability and cycle life, they have their own advantages, which also leads to the differentiation of the technical route of positive electrode materials for power 4LR44 battery.

In 2002, lithium iron phosphate (LFP) was industrialized by Valance of the United States for the first time, which immediately attracted widespread attention in the Chinese market. Since 2004, my country has set off a wave of investment in lithium iron phosphate materials and lithium iron phosphate power batteries. Subsequently, it has become the main route for positive electrode materials in my country, and the controversy has come to an end.

However, as Tesla used nickel cobalt aluminum oxide positive electrode materials in power batteries, the controversy reappeared. At the 2014 Second China (Chengdu) Lithium Battery New Energy Industry International Summit Forum held recently, this topic was also a hundred schools of thought. The reporter of "Daily Economic News" noticed that the controversy mainly focused on the safety, energy density and cost of lithium battery positive electrode materials.

Professor Qi Lu of Peking University believes that the lithium manganese oxide series represents the future development direction. Recently, after communicating with domestic battery manufacturers to varying degrees, Qi Lu believes that the stability of lithium manganese oxide batteries of some domestic manufacturers is relatively good. The progressive lithium manganese oxide battery can be deeply charged and discharged for 2,000 times, and the capacity is still maintained at more than 80%, which means that according to the current life of the car, it can be used for 5 years or even longer.

"Whether from the safety factor or the comprehensive consideration of energy density, lithium manganese oxide batteries are an important direction for the development of power 4LR44 battery in the future; and lithium manganese oxide with a progressive structure doped with nickel is an important development direction for the next generation of electric vehicles and is worthy of everyone's attention." Qi Lu said.

Li Jianzhong, president of Dangsheng Technology, believes that in terms of energy density, lithium manganese oxide is better than lithium iron phosphate, nickel-cobalt-manganese multi-material NCM is better than lithium manganese oxide, and nickel-cobalt-aluminum material NCA is better than nickel-cobalt-manganese multi-material NCM.

Dangsheng Technology is the largest lithium cobalt oxide manufacturer in China. As lithium cobalt oxide is increasingly unable to adapt to the market, the company's performance has been mediocre in recent years. In order to seek transformation, the company is actively transforming to ternary materials. In Li Jianzhong's view, NCM/NCA will become the mainstream positive electrode material for 4LR44 battery used in electric vehicles in the next 3 to 5 years.

Mo Kexian, an expert who has been paying attention to the lithium battery industry for a long time, said that he is a little worried about the future of lithium iron phosphate, because the gap between its technological progress and that of lithium manganese oxide (including ternary materials) is not narrowing, but widening. Now electric vehicles are basically withdrawing from lithium iron phosphate because lithium manganese oxide series ternary materials are more suitable.

BYD, which has always used lithium iron phosphate as a power battery, also recognizes the shortcomings of lithium iron phosphate. Earlier this year, Wang Chuanfu, chairman of the company's board of directors, said that it is developing lithium iron manganese phosphate positive electrode materials with higher energy density, and the energy density will increase by 60% compared with lithium iron phosphate.

According to statistics in 2013, 80% of the positive electrode materials for power batteries in China are still lithium iron phosphate, but ternary materials have also entered the selection range of Chinese batteries, with a usage share of about 20%.

How to balance the range and cost/

Behind the dispute over the power lithium battery technology route, it is not only the result of the "panic" of domestic power automobile manufacturers and power lithium battery supporting manufacturers after the "Tesla whirlwind" impacted the lithium iron phosphate technology route for many years, but also reflects the lack of research on potential customer needs and the vague positioning of their own products in the future by domestic new energy automobile and lithium battery supporting manufacturers.

Li Jianzhong pointed out: "Rather than a route problem, it is better to say that the lithium battery industry makes different choices based on its product recognition and technical level at different stages of development."

Speaking of customer demand research, Wang Zidong, director of the Power Battery Laboratory of the China North Vehicle Research Institute, believes that the private market for electric vehicles is a segmented market. Some people buy electric vehicles for commuting, while others use them to pick up children or send the elderly. These are all segmentations, and these segmentations have different requirements for mileage and vehicle size.

In the development of new energy vehicles, how to balance the range, cost and safety of new energy vehicles is also a problem that car companies must think about.

In this regard, Qi Lu, a professor at Peking University, told the reporter of the "Daily Economic News" that some of our ideas about electric vehicles should also undergo some changes. The relationship between mileage and speed should be handled according to the actual situation. We should change the previous misconception that electric vehicles should exceed fuel vehicles and run 500 kilometers on a single charge. We should fully consider various factors such as battery weight, cost and safety. "So, under the current situation in China, I think the performance of electric vehicles and batteries can fully meet the needs from different angles."

Regarding the confusion in the product positioning of domestic new energy vehicles, Mo Ke told the reporter of "Daily Economic News" that the market positioning of products should be clarified according to the different mileage. He believes that pure electric vehicles are mainly short-term transportation within 150 kilometers, and plug-in hybrid vehicles above 150 kilometers.

Repositioning of new energy vehicles/

Although new energy vehicles have seen a blowout growth this year under the continuous introduction of favorable policies by the government, an industry cannot rely solely on policies, but should follow market laws, otherwise it will be difficult to last.

Under the same safety conditions, the current new energy vehicles, considering the mileage and cost, still cannot compete with traditional fuel vehicles. Does this mean that without policy support, the development of new energy vehicles will fall into a "dead end"?

In response to this question, Wang Zidong believes that price is not the factor that limits the development of new energy vehicles. "In fact, electric bicycles are about ten times the price of ordinary bicycles. No one cares about the price when fixed-line phones are replaced by mobile phones. The price difference is even greater. If they cannot be sold because of the high price, then these two business projects should not be established, but now they are indeed established. So I personally think that price is not the decisive factor."

However, when fuel vehicles are replaced by electric vehicles, everyone is asking about the cost issue. Why is this?

Wang Zidong's explanation is: "The key is to design what kind of electric vehicle. Bicycles are replaced by electric bicycles, which adds a lot of things, such as lighter, more labor-saving, and farther travel. Mobile phones replace traditional fixed-line phones and also add a lot of functions. When electric vehicles replace fuel engines, no functions are added. This is the problem."

So, can new energy vehicles provide more functions than fuel vehicles and meet the new needs of consumers?

Zhu Baohua of Zhongke Investment talked about his own views: mobile Internet brings everyone information flow on people. Next, with the construction of charging networks and smart grids, the electricity of new energy vehicles will be chargeable and dischargeable. In this way, new energy vehicles are connected to the entire power grid, and the free flow and sale of energy can be realized.

He gave an example, saying that new energy vehicles can be charged at a low price during low-peak electricity consumption, and then sold at a high price during peak electricity consumption. Even if the electricity cannot be returned to the power grid, it can also meet the normal internal electricity consumption. In this way, very novel ways can be thought of to realize the free flow and sale of personal consumption energy. For example, when a few friends drive Tesla's electricity to go camping, they can form a power grid, and they can play outdoor movies on the beach, use air conditioning in the tent, and do many things.

Resource game

Upstream companies compete for lithium resource pricing power to extract lithium from salt lakes

Every Economic Intern Reporter Ding Zhouyang from Chengdu

As a major country with 27% of the world's lithium resource reserves, China has long lacked the pricing power of lithium resources, and the huge resources have not been converted into large-scale supply for the domestic lithium raw material market.

Recently, at the 2nd China (Chengdu) Lithium New Energy Industry International Summit Forum in 2014, Zhang Jiangfeng, Secretary General of the Lithium Branch of the China Nonferrous Metals Industry Association, said that the development and utilization rate of domestic lithium resources is not high, and "almost all companies must unconditionally accept the price influence of Australia."

"The ratio between lithium extraction from ore and lithium extraction from salt lakes is 3:7 internationally, while the situation in China is just the opposite." Zhang Jiangfeng told the reporter of the "Daily Economic News" that the cost of lithium extraction from salt lakes is much lower than that from ore because of the ability to obtain incidental minerals and dilute costs, but lithium extraction from salt lakes is restricted by technology and has not been applied on a large scale in industrialization.

With the dream of "turning salt lakes into gold lakes", companies continue to enter Qinghai and Tibet and buy salt lake mining rights, but the results are not ideal. "Qinghai's salt lakes invest more than 1 billion yuan each year, and most of them end up losing money." Zhang Jiangfeng revealed.

It is understood that unlike foreign salt lakes, plateau salt lakes contain too much magnesium, making it difficult to remove impurities, and the purity of lithium ore is unstable. Zhang Jiangfeng introduced that the technology of lithium extraction from salt lakes has made important progress and is expected to be industrialized in two to three years.

Lack of international pricing power

China's lithium resource reserves mainly come from salt lakes in Tibet, Qinghai and other places, as well as lithium mines in Sichuan, Jiangxi and other places. China's ore lithium resources are 750,000 tons, and salt lake lithium resources are 2.75 million tons, totaling 3.5 million tons, ranking among the top three in the world.

However, a statistical data in 2012 showed that more than 75% of the domestic lithium raw materials came from imported spodumene and salt lake brine, and the domestic salt lakes with rich reserves only provided 8% of the lithium raw material supply.

For a long time, the global supply and pricing power of lithium carbonate has been in the hands of four international lithium giants. Among them, the three major brine manufacturers SQM, Rockwood, and FMC account for a total of 45% of the global lithium market. After the only lithium concentrate supplier Talison was acquired by Sichuan Tianqi Lithium (002466, SZ) in 2012, its market share jumped to 35% based on the strong demand in the Chinese market.

At the end of October this year, the average price of lithium carbonate per ton was 41,000 yuan. "The price has gone up again in recent days, because on November 4, FMC announced that lithium salts, lithium carbonate, etc. would increase their prices by 10%, "said Zhang Jiangfeng.

The price of spodumene, which accounts for 70% of the direct cost of lithium carbonate, has also risen. According to a research report by Bank of China International, in mid-to-late September, spodumene suppliers will increase their quotes to US$60/ton, which means that the production cost will increase by an additional 3,000 yuan for every ton of battery-grade lithium carbonate produced.

The situation of insufficient development and utilization of lithium resources has prompted upstream companies to change their thinking. "In the past, the goal was to produce high-quality battery-grade lithium carbonate. This year, the strategy of upstream companies has been adjusted to develop lithium resources." Zhang Jiangfeng said. In short, the companies on the lake produce lithium resources and primary products, and the downstream companies will carry out deep processing to make up for the domestic lack of lithium resource development.

Can the salt lake become a "golden lake"?

In the lithium industry, the story of "pattern change" in the lithium extraction industry chain due to technological changes is not the first time.

In 1996, SQM relied on its own new salt lake lithium extraction technology to reduce the production cost of lithium carbonate from US$3,000/ton to US$1,500/ton, which directly led to the suspension of production of the then mining lithium extraction giants Gwalia and FMC, and became a lithium industry giant that controls international pricing power.

The entry of low-cost salt lake lithium extraction products into the international market has fundamentally changed the pattern of the world lithium market. At present, 70% of the lithium extraction products in the international market come from salt lake lithium extraction, all of which are self-owned mines. The cost of producing battery-grade lithium carbonate from salt lake lithium extraction is more than 5,000 yuan/ton lower than that of lithium extraction from ore.

Zhang Jiangfeng introduced that lithium extraction from salt lakes is the future direction of the development of the world's lithium industry. China is just the opposite. "70% of China's technology is still lithium extraction from ores."

Although the advantages of lithium resources in salt lakes distributed in Qinghai and Tibet have long been recognized by the industry, Zhang Jiangfeng said, "The difficulty of extracting lithium from salt lakes is that each salt lake is different, and it is impossible to copy mature foreign technologies." Especially in plateau salt lakes, the sunshine and temperature conditions are unstable, the magnesium content is high, and it is difficult to remove impurities.

The technical threshold has not stopped the enthusiasm of capital to enter. In August this year, Tianqi Lithium bought 20% of the shares of Tibet Shigatse Zabuye Lithium Industry High-tech Co., Ltd., which has the 20-year mining rights of Tibet Zabuye Salt Lake, for 311 million yuan.

According to a research report by Ping An Securities, one of the reasons for the previous years of losses in Zabuye Salt Lake was that the original lithium extraction process was "too costly": the amortization cost of more than 60,000 yuan per ton made Zabuye Lithium Industry still in a loss-making state in the years when the price of lithium carbonate was at a historical high.

Company sample

Huang Jihong, General Manager of Dongguan Shanshan: The electrolyte price war will continue

Huang Li, an intern reporter from the Economic Daily, sent from Chengdu

The increasingly competitive lithium battery market has put pressure on Dongguan Shanshan Battery Materials Co., Ltd. (hereinafter referred to as Dongguan Shanshan), which has a production capacity of only 4,000 tons/year.

In order to expand production capacity and further enhance its market position, Dongguan Shanshan has invested in the establishment of Hebei Langfang Shanshan Battery Materials Co., Ltd. (hereinafter referred to as Langfang Shanshan) in July 2013, and put it into production at the end of 2013, with a planned production capacity of 4,000 tons/year.

However, some experts believe that from the perspective of customer structure, Dongguan Shanshan has not yet truly entered the supply system of international manufacturers, and there is still a certain gap from first-class enterprises, and its competitiveness needs to be improved.

"We also want to enter the foreign market, but the 4,000-ton production capacity of Dongguan Shanshan alone is far from enough," Huang Jihong, General Manager of Dongguan Shanshan, told the reporter of the Daily Economic News that the production of Langfang Shanshan is an important step for the company to open up the international market.

She also said, "The market is expanding, and the price war will continue."

Filling the "internationalization" shortcoming

Looking forward to the promising market prospects of new energy, Shanshan Co., Ltd., which has crossed over from clothing, is constantly expanding and strengthening its lithium battery material business. Its wholly-owned subsidiary, Dongguan Shanshan, has been committed to the research, development, production and sales of lithium battery electrolytes.

Huang Jihong told the reporter of "Daily Economic News" that "Dongguan Shanshan has an annual output of 4,000 tons. Now in the industry, Guotai Huarong has an annual output of 10,000 tons, Xinzhoubang has an annual output of 10,000 tons, Tianjin Jinniu has an annual output of 7,000 tons, and Guangzhou Tianci has an annual output of 7,000 tons, so we set up Langfang Shanshan, which is also 4,000 tons/year, and it was put into production at the end of last year."

According to Huang Jihong, Dongguan Shanshan currently has cooperation with major domestic manufacturers, such as BYD, BAK Battery, ATL, etc.

"The new annual production of 4,000 tons of electrolyte project invested in Langfang, Hebei has been put into trial production.

Read recommendations:

R6P

Lithium battery market market.502030 polymer battery

3.2v 500ah lifepo4 battery.Analysis of the Application of Power Lithium Battery in AGV Power Battery

3.2v 200ah lifepo4 battery

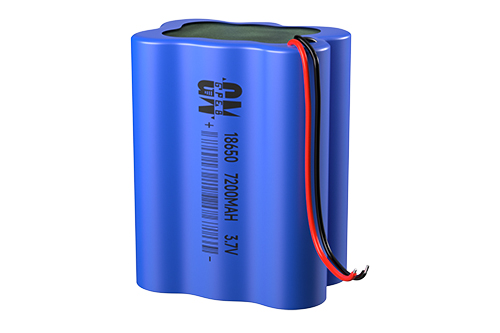

18650 lithium 3.7 battery

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP