Briefly describe the research report on the power CR2032 button cell battery recycling industry in the past two years

New energy vehicles and power batteries maintain a steady high growth

New energy vehicles have obvious environmental advantages and have entered a stable development period

Compared with traditional vehicles, the advantages of new energy vehicles in environmental protection are mainly reflected in:

Low emission of harmful particulate matter: Due to the use of electricity, hydrogen or mixed energy, it contains less harmful substances such as lead, benzene and particulate matter, and its own exhaust emission pollution is smaller than that of traditional fuel vehicles. Even if it is converted into power plant emissions based on the power consumption, the pollution caused is less than that of traditional vehicles, because the energy conversion rate of power plants is higher, and centralized emissions can more conveniently install emission reduction and pollution control equipment;

Improve energy utilization: Taking electric vehicles as an example, based on 15-20kWh of electricity consumption per 100 kilometers, considering the loss of power plants and motors, the energy consumption is approximately equal to 7kg of standard coal, and the energy consumption of traditional vehicles is approximately equal to 10kg of standard coal based on 10L of fuel consumption per 100 kilometers.

Based on the advantages of new energy vehicles in environmental protection, the state has introduced many preferential policies for the production, sales and purchase of new energy vehicles to stimulate the rapid development of the new energy vehicle industry.

The new energy vehicle market has seen a double explosion in production and sales and continues to maintain rapid growth. From 2013 to 2015, new energy vehicles achieved explosive growth, with production doubling year by year. Since 2016, growth has shifted from explosive growth to steady high growth, with production growth rates of more than 50% in the past two years. In 2017, production reached 794,000 vehicles, a year-on-year increase of 53.6%.

After the explosion, power batteries turned to steady high growth, with ternary and lithium iron phosphate batteries each accounting for half of the market

As supporting equipment for new energy vehicles, power batteries have also experienced a development from explosive growth to steady high growth. Overall, the total shipments of power batteries in 2017 were 38.2GWh, a year-on-year increase of 37.0%.

In the development and application of power batteries, major manufacturers take high-performance lithium batteries as the main object, and they are mainly divided into:

Lithium iron phosphate (LiFePO4) batteries and nickel cobalt manganese (NCM), nickel cobalt aluminum (NCA) and other ternary batteries. Among them, lithium iron phosphate positive electrode has stable chemical properties and long service life. At the same time, due to the low price of raw materials, it still occupies half of the power battery market;

The advantages of ternary material batteries such as high energy density, stronger temperature resistance and charging efficiency have made them more and more popular in recent years, and their share has increased rapidly.

A large number of power batteries are about to enter the retirement period, and the recycling demand is urgent, and the market space is broad.

For new energy vehicles, when the battery capacity decays to 70%-80% of the initial capacity, the battery needs to be replaced. The service life of electric passenger car batteries is 4-6 years, while commercial vehicle batteries are more expensive, so the life is about 3-5 years.

Since the vigorous promotion of new energy vehicles began after 2013, it can be inferred that the first batch of battery replacement pilots will be around 2018, when the retirement and renewal of power batteries are also expected to usher in explosive growth.

We assume that the battery life of new energy passenger vehicles is 5 years, and that of commercial vehicles is 4 years. The renewal rate after expiration (i.e. the total number of batteries that are actually retired/the total number of batteries that should be retired after the expiration of the life) increases year by year. Based on the production of power batteries in recent years, it can be calculated that by 2018, the newly scrapped installed capacity of power batteries may reach 11.14GWh, a significant year-on-year increase of 278.9%;

If it is assumed that the energy density of lithium iron phosphate and ternary material batteries is maintained at 0.11MWh/t and 0.18MWh/t, the corresponding weight is about 92,200 tons, a year-on-year increase of 273.3%.

Lithium batteries pose a great potential environmental threat

A large number of retired batteries will pose a potential threat to the environment, especially the heavy metals, electrolytes, solvents and various organic auxiliary materials in power batteries. If they are discarded without proper disposal, they will cause great harm to soil, water, etc., and the repair process will take a long time and be costly, so there is an urgent need for recycling.

There is still a lot of room for development in recycling and processing

1. The recycling system for retired batteries has been initially established, and the extension of producer responsibility promotes the closeness of the recycling network

Automakers are responsible for full traceability: Automakers give priority to the use of recycled raw materials, safe and environmentally friendly materials during production, consider recyclability and disassembly, and encode the products sold to consumers to establish a full life cycle traceability system.

Distributors and after-sales outlets guarantee recycling and disposal: At the same time, automobile manufacturers establish after-sales service outlets, count and publish recycling information, and ensure the standardized recycling and safe disposal of waste batteries.

Consumer-actively propose recycling: Consumers purchase and use automobiles/power batteries until they are scrapped, and notify the recycling department after the sale of automobiles.

The dealership and after-sales outlets recycle and notify the next recycling and disassembly: For batteries: After the after-sales outlets uniformly organize the waste power batteries, they notify professional battery recycling companies; For complete vehicles: Notify scrapped car dismantling companies to dismantle, and the dismantled batteries are recycled by themselves or notified by professional battery recycling companies.

Battery recycling companies complete the cycle by cascading utilization/disassembly and regeneration: Waste power battery companies classify the safety and availability of batteries, notify power battery recycling and resource regeneration companies, and reasonably allocate the usable power batteries to companies that need low-power batteries, or sell them to recycling outlets authorized by battery companies. The recycling outlets match the batteries by detecting the degree of waste, power and reusable value of different batteries.

For unusable batteries, dismantle them and sell the raw materials to the corresponding battery manufacturers to complete the cycle.

Under this policy background, the recycling system of power batteries will be further clarified, and the recycling mechanism of battery manufacturers-car companies-consumers-recycling/processing companies-battery manufacturers/other manufacturers will be recognized. Third-party recycling/processing companies can establish closer ties with upstream/downstream companies, and the small workshops mentioned earlier cannot be directly connected with legal channels, and their survival space is expected to be further compressed.

2. Recycling and regeneration plan: There is still room for improvement in cascade utilization, and the disassembly technology is highly mature. The replaced waste batteries mainly have two processing modes: cascade utilization and disassembly.

The recycling system of cascade utilization has been formed

Cascade utilization refers to the retired power batteries being used again in low-speed electric vehicles, backup power supplies, power storage and other fields with relatively good operating conditions and low battery performance requirements after testing, screening, and reorganization.

At present, the main areas of secondary utilization are still energy storage and peak load regulation. Taking China Tower as an example, its tower backup power, peak load filling stations and other reserve power demand is about 8800kWh (currently mainly lead-acid batteries with short service life, low energy density and low price). With the requirements of environmental protection and efficiency, the replacement of lead-acid batteries will open up a huge demand gap for the secondary utilization of power batteries.

At present, the secondary utilization technology based on PACK (battery pack, that is, multi-stage series-parallel battery module) + BMS (battery management system) is a more mainstream choice.

The PACK process is divided into three parts: processing, assembly and packaging. Its core is to connect multiple single cells in series and parallel through mechanical structure to form a battery pack.

In the specific operation process, due to the need to consider the mechanical strength of the entire battery pack, system matching and other issues, it is necessary to involve a large number of mature technologies such as thermal management, current control and detection, module assembly design and computer virtual development, which are cross-cooperation, and are high-threshold links in the process of cascade utilization.

The main function of the BMS battery management system is to intelligently manage and maintain each battery unit, prevent the battery from overcharging and over-discharging, and monitor the battery status in real time, thereby protecting the battery life.

BMS is a collection of management systems, control, display, communication, and information collection modules, which serves as a link between the vehicle, battery, and the entire battery system. For battery manufacturers, BMS reflects the core technical competitiveness of the manufacturer, and for the cascade utilization of power batteries, BMS determines the scope of application, life, and overall value of the reused battery.

In a narrow sense, secondary utilization refers only to the reorganization and reuse of batteries. However, the current secondary utilization and recycling system of lithium iron phosphate batteries has been formed, and its connotation has become a full-cycle, multi-level utilization centered on available resources: When a vehicle enters the scrap period (generally, the service life of a vehicle is longer than that of the battery), it will experience:

(1) High-performance battery screening: Car companies, car dismantling plants and some recycling companies will screen out batteries with high consistency and relatively good performance from scrapped batteries through testing and other methods, and assemble or entrust other companies to assemble them into battery packs, and then sell them to downstream secondary utilization companies represented by China Tower.

(2) Disassembly: For batteries in poor condition and without direct utilization value, most of them will be collected by third-party recycling companies. Recycling companies use physical or wet methods to disassemble and reuse them, extract raw materials such as copper, aluminum, and diaphragms, and sell them directly. The positive and negative electrode material powders of lithium iron phosphate batteries will enter the repair stage.

(3) Repair: The purpose of repair is to further purify the lithium iron phosphate material powder to obtain a higher selling price. At the same time, retired batteries after cascade utilization will also undergo disassembly/repair processes to achieve multi-dimensional layered utilization.

In the entire cycle process, general recycling companies have three profit points, namely (1) selling batteries that are in good initial screening status and can be directly recycled; (2) selling disassembled raw materials; (3) selling repaired positive/negative electrode materials.

However, cascade utilization currently faces two problems: technical and commercialization.

From a technical perspective, due to the poor consistency and different lifespan of power batteries, the data of the BMS system will deviate from the actual condition of the battery, which will make the cascade utilization process face challenges in safety and product quality;

From a commercial perspective, on the one hand, the standardization of products currently recycled is relatively low, and on the other hand, due to the different battery models, the number of batteries required for assembly will be large, so the screening, assembly and processing costs are still relatively high, and only a few companies with mature technology can obtain economic benefits.

Despite this, many industry leaders have reached strategic cooperation agreements on research and application with downstream utilization companies such as China Tower. With the continuous introduction and implementation of various standards for power batteries, the consistency of batteries will be greatly improved, and close cooperation will solve the application problems of cascade utilization in the future.

The disassembly technology of ternary batteries is relatively mature

For ternary material batteries, the commonly used recycling method is still disassembly, and its disassembly products such as nickel, cobalt, lithium, copper, and aluminum still have high economic value (the recycling cost of lithium iron phosphate is close to the disassembly income, and the disassembly efficiency is low), which is generally used for the remanufacturing of power batteries.

At present, the recycling process is mainly divided into dry method, wet method and biological recycling. Among them, the wet method is the current main process, with a high recovery rate and the ability to carry out directional recovery of precious metals; the dry method is generally used as a supporting process for the wet method, mainly used for the initial treatment of metals, while the biological recycling is still in its early stages and the technology development is still immature.

According to the "Provisional Management of Industry Standard Conditions and Industry Standard Announcement Management for the Utilization of Waste Power Batteries of New Energy Vehicles" issued by the Ministry of Industry and Information Technology in 2016, it is encouraged to use a combination of dry and wet methods to recycle power batteries.

At present, the recycling and dismantling market is relatively fragmented, and the proportion of ternary material batteries in the current retired batteries (mostly around 2014) is still relatively low. However, since nickel, cobalt and other precious metals are still scarce resources in the upstream industry, the dismantling of ternary batteries has great potential.

3. Recycling channels are gradually formed to solve the pain points of irregular operation models

As the power battery recycling market is still in the early stages of development, various irregular phenomena still exist, mainly manifested in:

(1) Small enterprises' technology and environmental protection are still not up to standard

At present, small and medium-sized enterprises in the market generally use crushing for recycling and resource utilization, and the crushing method is mainly unified crushing, that is, the raw materials are put into the hopper and crushed into powder and flakes, and copper powder and aluminum powder are recovered through dust coarse classification. On the one hand, copper powder and aluminum powder have high impurities, and on the other hand, environmental protection is seriously not up to standard. However, due to the scattered distribution of small enterprises, supervision still cannot fully reach them, which still hinders the intensive development of the industry.

(2) Battery transportation costs are high and highly regional

Battery transportation is considered hazardous waste transportation. The cost of off-site treatment will increase due to high transportation costs. Small-scale enterprises cannot dilute costs by increasing turnover, so more companies tend to recycle and process locally. For businesses that require transportation, some non-standard enterprises take the approach of cooperating with transportation companies with hazardous waste transportation qualifications to "play the edge ball". They operate in the name of hazardous waste qualified enterprises but do not use hazardous waste special vehicles. Although this reduces costs, it creates huge environmental pollution and safety risks.

Although irregular industry behavior still exists, companies represented by large automobile companies have strengthened the construction of recycling and utilization networks by actively connecting various links in the industrial chain.

From the perspective of car companies, they promise consumers a battery life. When the battery is scrapped ahead of schedule and the promised use period has not expired, consumers can replace it with the scrapped battery at terminal channels such as 4S stores. Car companies usually replace the battery with a better state of cascade utilization. In this way, consumers' battery use in the remaining promised period is basically unaffected, and car companies can recycle batteries at both the recycling and utilization ends.

Car companies actively promote recycling, which is an important part of the formalization of the entire recycling channel. The recycled power batteries will then flow into professional battery recycling and reuse companies with qualifications and technology.

Read recommendations:

Coin Battery CR 3032

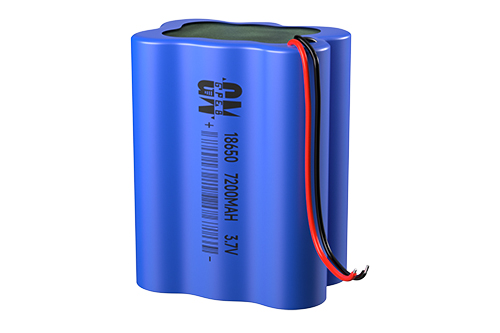

Lithium ion battery separator structure.battery 18650 rechargeable

32700 battery

801620 battery sales

1.5v Dry Battery

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP