Lithium Market Research: The Dilemma of Overcapacity

If you want to say which metal element can serve as an aerospace-grade

alloy at present and even in the future, then the lithium element has to be

mentioned here.

The first lithium ore was discovered by Brazilians on a small island in

Sweden. After he accidentally threw some unknown ore into the fire, the fire

glowed with crimson flames. Later, John August Avvidsson of Stockholm analyzed

and studied this phenomenon and concluded that it contained a previously unknown

metallic element, and named it lithium.

Lithium (Li) is a silver-white metallic element. Its physical properties

are soft, extremely small in density and the potential can reach the most

negative state. In addition, its chemical properties are also very active. It

exists in the form of compounds in solid lithium ores and salt lake brine mines,

without natural lithium. It is for this reason that lithium is considered to be

the lightest and most active metallic element in nature.

Open Baidu APP to view more high-definition pictures

Due to this excellent characteristic, lithium can not only be used as a

catalyst, initiator, and additive, but can also be used to directly synthesize

new materials to improve product performance. Therefore, lithium is not only

used in atomic energy, aerospace, and special cutting-edge industries, but is

also widely used in high-tech fields such as metallurgy, electronics, glass

ceramics, petrochemicals, batteries, rubber, steel, machinery, and medical care,

as well as in traditional industrial fields. It became the energy metal of the

21st century.

Since lithium has a complete industrial grading system, an industrial chain

has been formed from upstream salt lakes and ores to midstream lithium products,

and then downstream involving traditional industries, new materials, new energy

and other fields.

From an upstream perspective, the sources of lithium are mainly salt lakes

and rock mines. The rock minerals are granitic pegmatite deposits, which mainly

include spodumene and lepidolite. Salt lakes around the world are mostly

distributed in South American countries such as Chile and Argentina. Spodumene

mines in rock minerals are mainly distributed in Australia, Canada, Zimbabwe,

Zaire, Brazil and China. Lepidolite mines are mainly distributed in Zimbabwe,

Canada, the United States, Mexico and China. Among them, spodumene from rock

minerals is the most lithium-rich and suitable raw material for industrial

utilization. It is also the solid lithium ore that is currently mainly developed

and industrially applied in the world.

From the midstream perspective, according to the production process and

product chain of lithium products, the lithium industry can be divided into two

sub-sectors: basic lithium products and deep-processed lithium products. Among

them, basic lithium products are mainly extracted from ores or brine, including

industrial grade lithium carbonate, lithium chloride and lithium hydroxide.

Deeply processed lithium products are follow-up products formed by deep

processing of basic lithium products. Currently, they include dozens of products

such as metallic lithium, butyllithium, catalyst-grade lithium chloride,

battery-grade lithium carbonate, and lithium fluoride.

From a downstream perspective, lithium product applications involve the

derivation of basic lithium products and deeply processed lithium products. The

scope of direct application of basic lithium products is small, and their uses

are mainly additives in the production process of traditional glass and

metallurgical industries. Deeply processed lithium products will be produced

based on the special technical and performance requirements of new downstream

products and have a very wide range of uses. In particular, the promotion of the

production and application of deeply processed lithium products is an important

foundation and driving force for the future development of the lithium industry.

At present, the demand for deep-processed lithium products is focused on

medicine, batteries, petrochemicals and new building materials. Among them,

lithium batteries for new energy vehicles are the main application in the

lithium industry, and the global market share is close to about 50%.

In 1974, the total proven reserves of global lithium resources were only

1.6 million tons, most of which were pegmatite lithium resources, and brine

lithium resources accounted for only 2%. However, with the discovery of salt

lake brine lithium resources, global lithium resource reserves began to increase

hundreds of times. By 2018, the total proven reserves of global lithium

resources had grown to 53 million tons, and brine lithium resources accounted

for 10% of the total lithium resource reserves. The proportion also increased

from 2% to 70%. Due to the large number of discoveries of brine lithium

resources and the substantial growth of global proven reserves of lithium

resources, in the context of the development of new energy vehicles, biomedicine

and new materials in recent years, sufficient guarantee has been provided for

the production of lithium products.

At present, the most economically developed lithium resources are mainly

located in Chile, Argentina, Australia and China in South America. These four

countries account for 95% of the global supply of lithium raw materials. Among

them, global lithium resource supply is in the hands of international giants

such as Talison (51% equity and ALB 49% equity), SQM, Reed Industrial Minerals,

Albemarle, Galaxy and Orocobre. The top five manufacturers supply nearly 80%.

For downstream lithium compounds such as lithium carbonate and lithium

hydroxide, the top five suppliers are Albemarle, SQM, Ganfeng Lithium and FMC,

accounting for a total of approximately 73%. Generally speaking, global lithium

resources are monopolized by a few giants.

At this stage, in the field of global lithium resource use, glass and

ceramic applications account for 28%, batteries (energy storage lithium

batteries 1%, 3C lithium batteries 12%, power lithium batteries 30%) account for

43%, and grease applications account for 43%. 9%, and other industrial

applications account for 20%. From the perspective of application structure

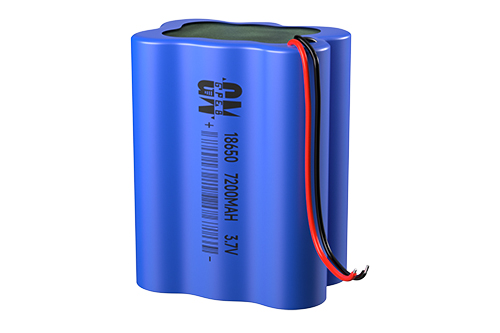

distribution, the lithium 18650 battery 3.7v 2200mahindustry has become the most

important field of lithium resource application. With the large-scale promotion

of new energy vehicles in the future, the application proportion of lithium

electric vehicles will increase significantly. It is expected that by 2022, the

proportion of lithium in 18650 battery 3.7v 2200mahapplications will reach

72%.

Since 2000, the lithium industry has experienced two rounds of price cycle

fluctuations. The first cycle was from 2005 to 2009, and the second cycle is

from 2015 to the present. As the main raw material for lithium 18650 battery

3.7v 2200mahmanufacturing, the price of lithium carbonate has risen from

US$2,000/ton in 2000 to a peak of US$24,000, benefiting from the impact of the

3C electronics era from 2005 to 2009 and the power 18650 battery 3.7v 2200mahera

since 2015. USD/ton, the price has tripled, becoming a veritable “precious

metal”.

However, the sharp rise in lithium carbonate prices has driven relevant

global companies to actively expand production on a large scale, resulting in

oversupply due to the rapid release of lithium production capacity, which has

ultimately led to a decline in lithium carbonate prices since the beginning of

2018. After a year of adjustments, the supply and demand structure began to

gradually improve. Although the price decline of lithium carbonate has been

relatively small so far, it is still falling. However, looking at the lithium

production capacity in 2018, the four companies ALB, SQM, FMC and ORC have a

production capacity of 155,000 tons. The production capacity is expected to

increase to 280,000 tons in 2020, with an average annual compound growth rate of

30%, which is still larger than the lithium carbonate market. The growth rate of

demand.

Faced with the continued decline in lithium prices, most companies'

production and sales ratios have declined, and their cash flow conditions have

deteriorated. At the same time, some companies are also facing high debt

maturity and difficulties in refinancing. Among them, high-cost projects are

experiencing production reductions, production suspensions, and even bankruptcy

reorganizations. . Overall, the lithium industry has entered the stage of

reducing overcapacity and destocking. Therefore, in the future, the overall

popularization process of the global new energy vehicle industry will be needed

to promote changes.

Ganfeng Lithium Industry (002460): The world's third largest and China's

largest lithium compound manufacturer and the world's largest metal lithium

manufacturer. It has the production capacity of more than 40 kinds of lithium

compounds and metal lithium products in five categories. It is a supplier of

lithium series products. One of the most complete manufacturers. Affected by the

continued decline in global lithium prices, the company's gross profit margin

dropped from approximately 40% in 2017 to 23% in the third quarter of 2019. At

present, its salt lake project is put into production. In 2021, the company's

lithium carbonate raw material will be switched to salt lake brine. The cost is

expected to drop by 25%, which is expected to improve performance.

(002466): The world's leading supplier of new energy materials with lithium

as its core. Affected by the continued decline in global lithium prices and the

lithium industry entering the stage of reducing production capacity and

inventory, the company incurred US$3.5 billion in debt due to the acquisition of

SQM in 2018, which resulted in a significant increase in financial expenses that

year, dragging down performance. At present, the company is preparing to reduce

debt through allotment of shares, issuance of bonds, or cash dividends from

giant lithium manufacturers that hold shares. In addition, although the gross

profit margin dropped from 70% in 2017 to 60%, it can still be maintained at a

high level thanks to cost advantages.

Read recommendations:

Ni-MH AAA700mAh 1.2V

Advantages and disadvantages of lithium iron phosphate battery

Composition of marine power battery packs

14250 battery

18650 battery pack 3.7v

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP