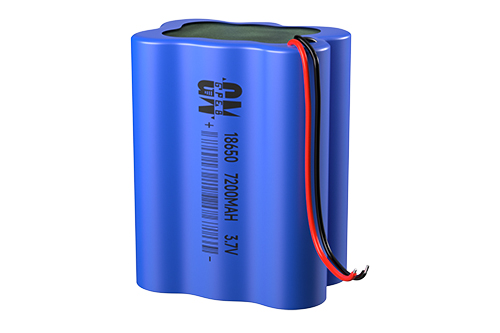

Why do car companies want to control the lifeline of power 18650 rechargeable battery lithium 3.7v 3500mah

In recent years, domestic new energy vehicle OEMs have established their own battery production companies. When the industry has just emerged, this is undoubtedly a wise move and an inevitable trend. Because China's battery technology has a short history and the standards are not mature. For example, in the early days of General Motors, Durant established a full set of parts supply systems and carried out industrial integration through self-construction and joint ventures.

In addition to self-built factories, car companies mainly adopt external procurement, joint venture holdings, division of labor and coordinated industry alliances to purchase and support power batteries. What is more interesting is that the control of power batteries is gradually moving closer to car companies. Typical cases are the integration of power battery industries such as Geely, BAIC, Dongfeng, and JAC, as well as the cooperation between BYD Battery and Changan. The most obvious event is the withdrawal of Xinwangda, and Chery completely controls Qida's equity.

1. Why do car companies want to control the lifeline of power batteries?

For car companies, how many business opportunities and investment opportunities are contained in controlling power battery technology?

First, the battery profit margin is large, subsidies are pushed, and vehicle cost control is the key. The main cost structure of an electric car is the power system, chassis, interior, electronic appliances, etc., and the power battery accounts for about 40% of the total vehicle cost, with high costs and large profit margins.

Industry insiders revealed that the current price of power batteries on the market is about 1,300-1,400 yuan/kWh, and the profit is about 7-10%. For an electric car equipped with 40kWh, the power battery pack costs about 52,000-56,000 yuan, and the profit of a car's power battery is about 3,640-5,600 yuan. It is estimated that if a car company sells 20,000 electric cars a year, it will make 73-112 million yuan in profits from the battery sector every year.

However, battery companies are currently facing several embarrassing situations. First, the price of battery materials continues to rise, and subsidies are declining. Car companies continue to lower prices. The price of power batteries is falling every year. It is expected that the price will drop to 1 yuan/Wh by 2020, and the profit margin will also decrease accordingly. Therefore, as vehicle manufacturers, car companies can better adjust and optimize vehicle costs to meet future market demand by controlling the lifeline of battery technology.

Second, car companies want to avoid the impact of insufficient production capacity of power battery companies on automobile manufacturing and sales. Although there is an overcapacity of power batteries, there is a serious shortage of high-end production capacity, which seriously affects the production and sales of car companies.

Third, car companies have mastered power battery technology and have enhanced their ability to control product quality. From the recent incidents of electric vehicle fires, it can be seen that most of them are caused by thermal runaway of power batteries. Generally speaking, once a vehicle catches fire, the first person responsible is the car company, not the power battery company. The recent mutual shirking of responsibility between WM Motor and Gushen Energy Battery is actually the concern of car companies about batteries. Car companies are unwilling to bear the accusations from society. The author believes that WM Motor's shirking of responsibility is a lack of "confidence" in the quality of its own vehicles and an anxiety about "battery" technology, because batteries are selected by car companies and they have a say in the control of battery quality. Once a vehicle catches fire or fails, the first person responsible should be the car company, and the second person responsible is the battery company.

Fourth, car companies do not want to be "kidnapped" by power battery companies and become the "foil" of battery companies. Then, car companies become "foil" mainly in the following aspects:

(1) Car companies become "OEMs". In the past few years, battery companies have reverse customized vehicles and required car companies to only carry the batteries they produce. For example, Wattma tied Dongfeng Special Automobile and other car companies together. Dongfeng Special Automobile became Wattma's OEM and mass-produced customized models for it. In this case, car companies have poor initiative and can deliver after production. The sales end is completely monopolized by battery companies.

(2) Car companies become "chess pieces". Under the oligopoly economy, the situation of power battery monopoly is becoming more and more obvious. CATL continues to expand its "circle of friends" and has signed cooperation agreements with many well-known car companies at home and abroad, such as GAC, Jiangling, BMW, and Weilai. BYD has also made corresponding countermeasures to supply power batteries to the outside world. It can be seen that car companies have always been the "flags" behind battery companies. When two battery companies compete, they will eventually have to "play the game" together.

(3) Car companies become "relatives" of battery companies. At present, battery companies have established connections with car companies. There is no need to say much about the first-tier companies such as CATL and BYD. Second-tier companies such as Guoxuan, Farasis, and Lishen are also very crazy, and they use this "marriage" method to obtain larger orders from car companies. Looking at the strategies of major battery companies, CATL is accustomed to using joint ventures to carry out cooperation. Car companies have a dominant position in battery systems, while CATL has a dominant position in battery cell manufacturing. The two joint ventures have independent legal persons and financial settlements. Lishen and Farasis also use joint ventures to establish companies to carry out business, but the majority of them are battery companies. Guoxuan, on the other hand, uses a holding method and invested 1.06 billion yuan to participate in the B round of financing of BAIC New Energy.

(4) After battery companies "kidnap" vehicle companies, it will have a certain impact on the vehicle companies' independent selection of battery products, thereby affecting the personalized design and all-round sales of vehicles.

2. Car companies are not "ordinary people", they have their concerns

In the market economy, both car companies and battery companies will have their own wishful thinking, it's just "one is willing to fight and the other is willing to be beaten", see who has the harder hammer and who gets the greater benefits. From this perspective, some traditional car companies are more "shrewd" than some battery companies, and their way of playing cards is also unexpected.

(I) Geely: gradually starting to match its own batteries

Let's put BYD aside. It has created an industrial closed loop from the beginning, and its own batteries supply its own cars. However, from the recent announcement, it can be seen that vehicle companies have begun to match their own batteries, such as Geely.

Geely has carried out power battery layout by building its own battery factory and investing in other mature battery factories.

(II) BYD: Blooming all over the country, building battery factories in different regions

Most of Geely's investments are not direct holdings, but indirect holdings. For example, Hubei Geely Hengyuan, although it is a wholly-owned enterprise, invests through Hangzhou Maijie Investment Co., Ltd. Another interesting thing is that after Geely acquired LG Chem's production equipment and technology in Nanjing, it did not put them into use locally, but used these equipment and technologies in Zhejiang Hengyuan Battery to support Volvo's production.

Among all the car companies, BYD is the only one that has opened up the entire industrial closed loop. Although it recently cooperated with Changan, it was also forced by the situation. Even so, all BYD models use its own power batteries.

(III) BAIC: Adopting a joint venture and industrial integration model

As can be seen from the above chart, all BYD projects are mainly located in the southwest, and its own power battery factories are built in Shenzhen, Huizhou, Qinghai, Xi'an and Chongqing. Among these projects, the Chongqing project is mainly put into production and construction for Changan Automobile. It has established a joint venture with BYD to develop, produce and sell power batteries.

BAIC is different from the other two companies. It basically does not build its own power battery factory to supply itself. BAIC's main method is to build a joint venture with other power battery companies, and to build an industrial park to introduce power battery companies to settle in.

However, BAIC New Energy does not only use Guoxuan's batteries. Different batteries will be used for different models. In fact, BAIC is also a very typical car company. It is not willing to be "bound" by battery companies such as CATL and constantly seeks partners. In addition, the listing of BAIC New Energy has a great relationship with Guoxuan High-tech. The two companies have cooperated for a long time. BAIC EC180 mainly uses Guoxuan's batteries. After BAIC New Energy invested in the industrial park in Qingdao, it introduced Guoxuan High-tech to settle in, and 20% of electric vehicles will use Guoxuan's batteries.

(IV) The shareholding ratio of car companies in joint ventures is getting higher and higher, and even completely owned

The reporter can see from the shareholding ratio of power battery companies such as CATL, Guoxuan High-tech, Tianjin Lishen, Huating, Haibosichuang and vehicle companies such as Dongfeng, SAIC, GAC, BAIC, and Chery that the cooperation between the two parties is basically equal, and the focus of car companies' cooperation is on power battery systems.

Summary: Power battery investment projects have always been valued by various car companies. Major vehicle companies are constantly laying out their own battery factories to meet their own vehicle matching needs. The author believes that in the next few years, car companies will pay more and more attention to the integration of the entire industry chain, and the models they produce will mainly use their own batteries. From the above shareholding ratio, it can be seen that if power battery companies want to cooperate with car companies, they need to jointly establish battery production companies with car companies, and the shareholding ratio of car companies is basically the same as that of power battery companies. The author believes that with the rapid development of the new energy vehicle industry, joint ventures may gradually be swallowed up by car companies.

Read recommendations:

Personalized text bang sticker

Rechargeable batteries with materials.3.7v 18650 lithium battery.CR2032 button cell battery

Low Self-Discharge of Lithium-Ion Batteries

12v 400ah lifepo4 battery pack

CR1216 battery

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP