What is the industrial chain of button battery cr1620?

The lithium battery industry chain covers three main areas: upstream

resources, midstream core materials and downstream battery assembly.

The key to the development of the lithium industry lies in materials and

equipment technology. Lithium battery product technology is still relatively

lagging behind in the entire material and equipment field, but the number of

companies trying new technologies and quality paths is increasing. The Ministry

of Communications also plans to introduce method standards for the lithium

battery industry, accelerate the integration of the lithium battery industry,

increase the concentration of the power battery industry, and help develop

equipment and materials companies with mature and advanced paths.

1. Upstream resources

Lithium resources mainly consist of two parts. One is salt lake brine

lithium. The lithium chemicals extracted from salt lake brine are mainly lithium

carbonate and lithium chloride; the second is ore lithium. The lithium light

products classified in the ore are mainly spodumene, lepidolite, etc. Most of

the salt lake resources are located in South America (Bolivia, Chilean

highlands) and China (Qinghai-Tibet Plateau). The salt lake resources in South

America are basically controlled by the top three international lithium

industries (SQM, FMC and Rockwood), and the three salt lake lithium giants

account for the global lithium share. 62% of the market. Ore resources are

mainly distributed in Australia, North America and China. Among them,

Australia's Spudumen Mine has the highest grade and the largest reserves. Taylor

Leeson controls lithium ion from the world's largest producing mine.

According to data from the United States Geological Survey (USGS), global

lithium resource reserves in 2012 were 13 million tons, of which Chile had 7.5

million tons, a ratio of 57.7%, China had 3.5 million tons, a ratio of 26.9%,

and Australia had 1 million tons. , the ratio is 7.7%, and Argentina is 850,000

tons, the ratio is 6.5%.

With the development of the lithium industry, many companies are currently

mainly investing in the development of lithium resources, including Tibet

Mining, China-Singapore National Security Bureau, Lushang Holdings, Western

Mining and Salt Lake Group.

1. Tibet Mining: The Zabuye Salt Lake mined by the company is one of the

three largest lithium salt lakes in the world, ranking second in the world, with

a resource potential value of 150 billion yuan. Tibet Mining is working hard to

achieve the long-term goal of 25,000 tons of lithium carbonate series per year

within 5 years.

2. CITIC National Security Bureau: Qinghai National Security Bureau has a

production capacity of 35,000 tons of lithium carbonate. The holding subsidiary

League Guli (90%) owns 1,500 tons of lithium drill bits and 500 tons of lithium

manganese oxide. The Qinghai Salt Resource Comprehensive Project developed by

the company has a total lithium chloride resource reserve of 7.6385 million

tons.

ˆ 2.2~3.89 g/L; CITIC National Security Bureau currently invests in the

construction of a total of 20,000 tons of lithium carbonate projects.

3. Lushang Shares: The Longdali Industry in Ganzi Prefecture acquired by

the company is the "No. 1 lithium mine in Asia" and the No. 134 mine of the

Minjikariya Mine has the right to mine 5.114 million tons of lithium ore and

controls nearly 30 million tons of lithium ore underground. The ore ranks first

in the country, first in Asia and second in the world.

2. Breakthrough in mid-stream core materials

The performance is twice the original, the cost is twice the original,

mainly depends on the material. More than 70% of battery cost is composed of

materials, and battery performance is also determined by materials.

Should be composed of five parts: anode material, cathode material,

electrolyte, diaphragm and packaging material. Among them, packaging materials

and graphite cathode technologies are relatively mature, and the cost ratio is

not high. The key materials of lithium-ion batteries are mainly cathode

materials, electrolytes, and diaphragms. The cathode material is the decisive

factor in the electrochemical performance of lithium-ion batteries. The cost

ratios of electrolyte and separator are 10% and 20% respectively, which are the

main components of negative electrode materials accounting for more than 40% of

the cost of button battery cr1620.

At present, China is self-sufficient in stages in four core material

fields: bipolar materials, cathode materials and electrolytes. Only separator

materials are heavily dependent on imports, but the development speed is also

very fast.

Cathode material

The lithium battery cathode material market is mainly occupied by lithium

diamond, ternary materials, lithium oxide, lithium iron phosphate and other

products. According to statistics from Japan's lithium power industry research

institute IIT, among China's lithium battery cathode materials, lithium

diamondate accounts for 49%, ternary materials account for 22%, lithium

manganese oxide accounts for 16%, lithium phosphate accounts for 6%, and other

materials account for 7%. %.

At present, the only commercial cathode material on the market is lithium

drill bits. However, in terms of performance, lithium has high safety risks such

as low drill times and low crystal thermal stability, and is only suitable for

small batteries. Lithium phosphate has a cycle count of more than 2,000 times,

is low-priced, non-toxic and environmentally friendly, and has better

performance than ternary materials and lithium manganese oxide. Therefore,

lithium-manganese ternary materials and lithium phosphate are the two mainstream

technical directions in the battery field and super-capacity power.

In the two mainstream directions, lithium iron phosphate is the main

technology promoted in China, so the market is hot. This product, which

attracted domestic attention in 1997, plans to invest 2 billion won in

investigation in the second year. But industrialization is still in its early

stages. There are 60 to 70 domestic companies that have completed the purchase

of lithium phosphate production lines, with a total annual production capacity

of nearly 20,000 tons. However, there are only more than 10 industrialized

mass-producers, and the production scale is small, and the rest are in the trial

production stage or pilot production stage.

Lithium manganese oxide ternary composite materials are the main technology

promoted by Japan and South Korea. They have considerable cost advantages.

Therefore, the international and domestic market share has increased in recent

years, but there is also a phenomenon of insufficient construction in our

country.

Unlike South Korea, which focuses on developing batteries using lithium

manganese oxide and ternary substances as two poles, the United States mainly

develops power batteries using lithium iron phosphate as the cathode material.

U.S. lithium iron phosphate battery manufacturer representatives a123systems

(Nasdaq3360aone) and Valence (Nasdaq3360vlnc). In recent years, these companies

have successively invested in China, built factories, saved costs, and actively

explored China's downstream market.

There are very few new construction and proposed projects studying

lithium, the market share has declined, and the industry has entered a period of

shrinkage. Two mainstream products, lithium iron phosphate and lithium manganese

oxide ternary materials in the fields of electric vehicles and energy storage,

will rapidly increase market demand. But there is still time to check who will

dominate the cathode materials of future batteries.

Cathode material

World-class lithium cathode material production capabilities are mainly

concentrated in China and Japan, showing obvious development trends of regional

concentration and enterprise concentration. Japan, through Mitsubishi Chemical,

Hitachi Chemical, Niu Chemical, etc., assumes the production capacity of the

country's main cathode materials. Japan's major cathode material companies have

also transferred their production capabilities to China, which is rich in

graphite resources, in order to be close to resources and reduce manufacturing

costs.

In 2012, the total market size of China's cathode materials was 2.08

billion yuan, a year-on-year increase of 15.3%.

Among them, natural graphite is 726 million yuan, artificial graphite

(except MCMB) is 1.061 billion yuan, and other cathode materials such as

medium-phase carbon microspheres and lithium titanate are 221 million yuan.

With the expansion of scale, the supply of cathode materials gradually

becomes excessive, and the price shows a downward trend. As the number of

cathode material manufacturers gradually increases, in order to gain market

share, newly imported cathode material companies tend to adopt low-cost

strategies. The supply industry is oversupplied, the market share of downstream

customer centers is concentrated, and the market share of small deep factories

shrinks. Cathode material companies The negotiation ability of downstream buyers

has further improved.

Electrolytes

The main raw material of the electrolyte is lithium hexafluorophosphate,

which accounts for about 50% of the cost of the electrolyte. At present, the

market is mainly monopolized by several Japanese companies such as Kanto

Denchemical Industry, Stella, and Morita Chemical, accounting for about 85% of

global capabilities.

In recent years, China has made breakthroughs in lithium

hexafluorophosphate production technology. Currently, inland companies producing

mass products include Tianjin Niu Niu, Tutu, Jiujiu District, Guangzhou Tianhui,

Chengdu Huangming Energy, Hubei Hongyuan Pharmaceutical, etc. Most downstream

electrolyte companies believe that the physical and chemical indicators of

lithium hexafluorophosphate from Illustration and Jiujiu long-term companies are

close to those of Japanese and Korean companies.

The quality of domestic lithium hexafluorophosphate is close to that of

imported products, and the price advantage of domestic lithium

hexafluorophosphate is obvious. The price of domestically produced lithium

hexafluorophosphate is 15% cheaper than imported lithium hexafluorophosphate.

Lithium hexafluorophosphate, the main cost source of electrolytes, is a

favorable factor for Chinese companies, because in order to reduce costs,

electrolyte manufacturers can only choose suppliers with suitable

price/performance ratio.

China's top five lithium battery electrolyte manufacturers Changgang

Huaying, Dongguan Fren, Shenzhen Hsinchu, Tianjin Niu, and Guangzhou Tianhui

basically use Tianjin Niu and Guangzhou Tianhui using self-generated lithium

hexafluorophosphate, and the remaining three have begun to use small quantities

Use domestic lithium hexafluorophosphate. It is expected that my country's

lithium hexafluorophosphate output will reach more than 90% in 2015.

China has abundant fluorite resources and is the largest fluorine

chemical production base in the world, providing a good industrial foundation

for the development of lithium hexafluorophosphate in my country. Based on the

domestic lithium hexafluorophosphate market, the global market share of domestic

electrolyte companies such as domestic Huaying, Dongguan Firson, and Hsinchu Guo

has increased. More importantly, Graphics, Jiulong, and Hubei Hongyuan have

mastered the core manufacturing technology of lithium hexafluorophosphate, and

these production products have been recognized by domestic electrolyte

manufacturers.

Chinese companies are expanding the field of lithium hexafluorophosphate,

and Korean, Chinese and Japanese companies are also actively deploying in

China.

Diaphragm

The production of diaphragms is the most difficult and the most

profitable. The main function of button battery cr1620 is to prevent the anode

and cathode from short-circuiting, and at the same time provide electrical

channels for ion transport during charging and discharging. At present,

polypropylene, polyethylene single microporous membranes and multi-layer

microporous membranes composed of the two are commonly used as separators. The

future development direction is thinner and safer.

The supply of lithium battery diaphragms is highly concentrated and

heavily dependent on imports. The main technology of diaphragms is in the hands

of a few companies, with a high degree of concentration. Overseas diaphragm

production is mainly concentrated in Selgard Company of the United States and

Asahi, Dongyan and AIA of Japan. Due to high technical barriers and high

investment risks, domestic companies are not very enthusiastic about

investing.

Places that can only produce lithium battery diaphragms in China include

Foshan Jinhuizi (a subsidiary of Bu Plastics Co., Ltd.), New Shangri-Laine,

Shenzhen Mingxingjiang, etc. The quality of their products is still very

different from similar foreign products. Among them, Foshan Jinhui's products

are of relatively good quality and are supplied to the mid- to low-end market.

The domestic market in the central and western parts of the country is mainly

monopolized by Dongyan, Asahika and Selgaard. Foshan Jinhui's products are

mainly used in the mid-to-low-end market, but the total sales profit is still

over 60%.

3. Downstream power battery production

In 2012, the market size of finished lithium battery packs in new energy

vehicles, grid energy storage, special vehicles, communication base stations and

other fields was 3.5 billion won, an increase of 34.6% from 2.6 billion won in

2011.

PM2.5 has set off a craze for environmental protection and strengthened

my country's efforts to develop new energy vehicles. But the popularity of new

energy vehicles is concentrated on city buses and taxis. Due to high prices,

lithium battery private cars and electric motorcycles have relatively low sales

and have not yet been accepted in the market.

Read recommendations:

6LR61

Carbon encapsulated cylindrical battery.CR2477 battery

Lithium Thionyl Chloride Primary Battery State - of - Charge Detection

602535 battery company

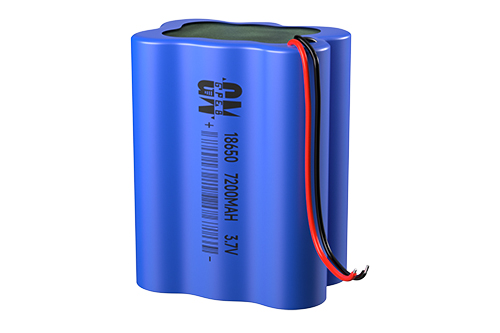

3.7v 2200mah 18650 lithium battery

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP