Research on the development path of industrialization of cr2032 3v lithium

battery

1. Basic concepts of power batteries

1.1 Definition

Power batteries refer to devices used in cars that can store electrical

energy and be rechargeable to provide energy for driving the car, including

cr2032 3v lithium battery, metal hydride nickel power batteries and

supercapacitors, etc., excluding lead-acid Class battery. At present, my

country's new energy vehicle power battery applications are dominated by

lithium-ion power battery systems. Due to the criticality of power batteries in

automotive applications, power batteries are likened to the heart of new energy

vehicles.

1.2 Classification

1.2.1 Industrial application of power batteries

At present, the mainstream application type of batteries for new energy

vehicles in the world is lithium-ion batteries. According to the difference in

cathode material system, lithium batteries currently used in the market can be

divided into lithium iron phosphate batteries, ternary batteries and lithium

manganate batteries.

Lithium iron phosphate battery, the cathode material is lithium iron

phosphate. This type of battery has the main characteristics of high

technological maturity, low production cost, good safety and long cycle

life.

The cathode material of the ternary battery is mainly composed of nickel,

manganese (or aluminum), cobalt and lithium elements. Currently, lithium nickel

cobalt manganate batteries have the highest market share. Ternary material

batteries have higher energy density, good charge-discharge rate performance and

low-temperature performance, but their safety and cycle life are not as good as

lithium iron phosphate batteries.

As the name suggests, the positive electrode material of lithium manganate

battery is lithium manganate. This type of battery has low cost, excellent rate

performance, and good safety. Its disadvantages are poor storage and cycle life

and low specific energy.

1.2.2 New power batteries under development

Under the trend of electrification in the global automobile industry,

vehicles with high driving range require power batteries with higher energy

density and better rate charge and discharge performance. Therefore, the next

generation of new system batteries should have high specific energy, high

specific power, high safety, cycle life and lower cost indicators. Currently,

the two main directions of lithium battery research are solid-state

batteries.

2. Current status of power battery industrialization development

2.1International aspects

2.1.1 Market analysis

From the perspective of the development pattern of the global power battery

industry, the current power battery material research and development and

technological innovation, manufacturing and industrialization have formed three

main gathering areas. They are the United States and Japan leading in research

and development, and the industrialization scale of China, South Korea and

Japan. maximum. In terms of market share, companies in China, South Korea and

Japan produce batteries that are used in nearly 95% of the world's cars, of

which Chinese brand batteries account for more than 60%. From the perspective of

comprehensive technology and industrial development, the United States and Japan

lead in technology research and development, South Korea leads in engineering

applications, and China leads in industrial scale.

Table 1 Global power battery companies support automobile companies

Data source: Compiled based on public information

2.1.2 Application analysis of mainstream technology routes

According to the different application needs of international and domestic

markets, lithium batteries with different technical routes are widely used in

both international and domestic markets.

Judging from the battery matching of global vehicle companies, Japanese and

Korean batteries are mainly used in well-known global car company groups, and

their application models include hybrid models, plug-in hybrid models and pure

electric models. In terms of technical routes, international vehicle power

battery cells are mainly based on lithium manganate and ternary material systems

(nickel cobalt manganese and nickel cobalt aluminum in high nickel systems). In

addition to CATL's extensive supply of batteries for international brand models,

my country's power batteries lack strong leading companies to participate in

international competition.

From the perspective of domestic vehicle power battery supply, the

commercial vehicle (bus, special vehicle) market has tended to develop steadily

under years of policy nurturing. There is little difference in the application

technology routes of each power battery. The main development trend is to

increase energy density. The main technical route is still based on lithium iron

phosphate. Domestic passenger car companies mainly use domestic brand power

batteries, and their product applications are mainly high-energy-density ternary

batteries.

In summary, in terms of the advancement and diversification of technical

routes, the diversification of matching models, and the degree of international

product development, the comprehensive strength of my country's power battery

companies still has greater room for development compared with Japanese and

Korean companies.

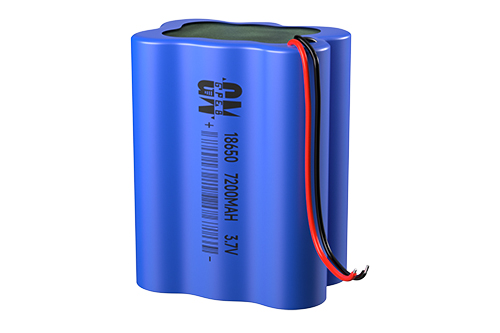

Figure 1 Technical roadmap of automotive cr2032 3v lithium battery

2.1.3 Development strategies of major global regions

The United States, Europe, and Japan have different development routes for

power batteries. The EU has gradually realized that power batteries are lagging

behind in industrial development. In order to avoid product supply dependence,

it has begun to promote the implementation of the "Battery Alliance" plan,

advocating that EU member states increase investment and promote the industrial

development of power battery production and recycling in Europe. . The U.S.

power battery industry has advantages in next-generation battery research and

development. One is the advantages in original innovation of materials and

engineering technology innovation. The United States leads the world in battery

basic material research and development technology and product integration

application technology. Second, in terms of key main materials for power

batteries, the United States leads the world in solid-state batteries, cathode

lithium battery materials, silicon-based anodes, separators, etc. Among them,

Dow Chemical leads the world in cathode materials and Celgard leads the world in

separator technology.

Japan's battery industry is smaller than China's, but it is leading the way

in deploying next-generation batteries. Japanese battery companies mainly

include two categories. One is joint ventures with Japanese vehicle companies to

develop and produce power batteries, and the other is independently supplying

batteries to global car companies. Panasonic is the representative company and

supplies many well-known companies such as Volkswagen, Tesla, and Ford.

Enterprise supporting facilities. In the field of next-generation battery

research and development, the Japanese Ministry of Economy has jointly developed

solid-state batteries with 23 automobile, power battery and material companies

including Toyota, Nissan, Honda, and Panasonic, and plans to fully master

solid-state battery-related technologies in 2022.

2.2 Domestic aspects

2.2.1 Industrial policy environment

In order to promote the development of the power battery industry, my

country has introduced a corresponding policy system, which includes industrial

support policies, development guidance, management specifications, etc. Relevant

policies are further divided into macro management policies, industry

development policies, administrative management and regulatory systems, and

feasibility research special support. At the macro level, the development

guidance clarifies the main tasks for the development of the power battery

industry, including basic and forward-looking scientific research deployment,

technological innovation goals, key common technological breakthroughs, and

cascade utilization and recycling of power batteries. In terms of industrial

management, in order to maintain market order, rationally allocate resources,

and promote industrial development, the National Development and Reform

Commission and the Ministry of Industry and Information Technology have issued

policies to implement standardized management of relevant enterprise operating

activities. With the support of this policy system, the technical level of power

batteries has rapidly improved, the industrial scale has continued to expand,

and market concentration has continued to increase. Under this industry

development trend, the power battery industry has experienced phased and

structural overcapacity, and the policy environment has accordingly shifted from

supporting the good and the strong to the survival of the fittest.

2.2.2 Industry characteristics

The characteristics of my country's power battery industry are high unit

investment (1GWh production capacity construction generally requires 500 million

yuan), high technical threshold, rapid R&D innovation, high talent

requirements, rapid upgrades, and high production automation requirements.

The power battery industry is a typical capital-intensive high-tech

industry, which is characterized by large capital investment, high-quality

personnel, high technical system threshold, rapid iteration of product

development, automated production equipment, and lean quality management. At

present, the construction scale of power battery companies is around 10GWh, and

the investment in project construction alone is at least 500 million yuan. Power

battery technology research and development and process engineering include

research and development of nano-level basic material properties, four main

material processes (positive electrode, negative electrode, separator,

electrolyte), battery cell manufacturing, battery system integration, etc. The

production process is complex, the environment is demanding, and the equipment

is precise. The requirements are extremely high, so the industry threshold is

very high.

2.2.3 Analysis of mainstream technology types

my country's power battery technology route is basically consistent with

global mainstream applications. The global automotive power battery product

application technology route is dominated by nickel-cobalt-manganese ternary

material batteries. The development of lithium manganate and lithium iron

phosphate technology routes has gradually slowed down. Advanced product

technology routes such as solid-state batteries have not yet formed large-scale

engineering applications. From the perspective of product specifications and

standards, the power battery system has gradually shifted from the basic

development of fuel vehicles to the forward development of new energy vehicle

platforms. The power battery system and the vehicle chassis are integrated into

the design, thus gradually forming battery cells, modules and system

specifications. The trend towards uniform size standards. In the global

competition, the core technical indicators and specifications of my country's

power battery single products are not far behind the world's advanced

products.

2.2.4 Analysis of regional industrial clusters

my country's power battery industry is mainly distributed in the

Beijing-Tianjin region, East China, Central Plains and South China. The industry

in the Beijing-Tianjin region developed earlier, dominated by enterprises such

as CITIC Guoanmeng Guli, Tianjin Lishen, Beijing Guoneng, Tianjin Jiewei,

Tianjin BAK, etc.; the Central Plains region has a traditional electrochemical

industry foundation and has formed an upstream materials-based industry and the

entire industrial chain of power batteries. The main enterprises include AVIC

Lithium Battery, Duofuoduo, Zhengzhou BAK, Henan Lithium Dynamics, Xintaihang,

Huanyu, etc. East China is the region with the most developed power battery

R&D strength, industrial scale, and upstream and downstream industry

foundations in my country. Large-scale market demand has driven the investment

and development of the power battery industry, including CATL, Guoxuan Hi-Tech,

Wanxiang, Tianneng, and Chaozhou. Well-known companies such as Weiwei and

Shuangdeng, the demand for vehicle power batteries from well-known car company

groups in the region has driven the development of the market and industry.

There are a number of digital product battery companies in South China. On the

basis of this industry, BYD, Waterma, Vision Power, Tianjin, Shenzhen BAK, Yiwei

Lithium Energy, Xinwangda, Zhenhua New Energy, Zhuo Neng New Energy and a number

of power battery companies.

2.2.5 Market analysis

The development of my country's power battery market is characterized by an

increase in the number of passenger car battery supplies, an increase in

high-energy density battery supplies, and a further increase in industry

agglomeration. According to statistics from the Power Battery Application Branch

of the China Chemical and Physical Power Sources Industry Association, my

country's new energy vehicle power battery supporting capacity exceeded 56.89GWh

in 2018, an increase of 56.88% year-on-year in 2017. The top 20 companies

installed 52.23GWh, accounting for 52.23GWh of the annual installed capacity.

91.8% of the installed capacity. Among them, ternary batteries accounted for

30.1GWh, accounting for 58.17%, an increase of 103.71% over 2017; lithium iron

phosphate batteries accounted for 22.2GWh, accounting for 39%, an increase of

23.51% over 2017; lithium manganate batteries 1.08GWh, accounting for 1.9% , a

decrease of 26.7% year-on-year in 2017; lithium titanate battery 0.52GWh,

accounting for 0.91%, a decrease of 8.99% year-on-year in 2017. From the

perspective of various power types, the cumulative installed capacity of power

batteries for pure electric vehicles is approximately 53.01GWh, a year-on-year

increase of 55.64%; the cumulative installed capacity of power batteries for

plug-in hybrid vehicles is approximately 3.82GWh, a year-on-year increase of

75.34%.

The survival of the fittest among enterprises in my country's power battery

industry is rapid, and the market structure of "two heroes + multiple powers"

has initially taken shape. In 2018, the cumulative supporting volume of the top

ten individual enterprises was approximately 47 billion watt-hours, accounting

for approximately 82.72% of the market. Among them, CATL and BYD are

significantly ahead in supporting volume, reaching 23.4 billion watt-hours and

11.4 billion watt-hours respectively. CATL’s market share increased from 29.0%

in 2017 to 41% in 2018, while BYD’s market share increased from 29.0% in 2017 to

41% in 2018. It increased from 15.5% to 20.1% in 2018. According to the

direction of industrial policies and industrial development trends, the

concentration of my country's power battery industry is expected to further

increase.

Table 2 Ranking of supply volume of power battery companies in 2018

Data source: Statistical analysis of Power Battery Application Branch of

China Chemical and Physical Power Supply Industry Association

2.2.6 Analysis of key enterprises

Judging from the supporting characteristics of power batteries, the product

types of traditional leading companies in the power battery industry, such as

CATL, BYD, Lishen, Guoxuan, and Funeng, can basically represent the mainstream

types of domestic products. First, the material system is mainly ternary and

lithium iron phosphate. ; Second, high-energy-density ternary batteries are

mainly used in passenger cars, and high-security, low-cost lithium iron

phosphate batteries are mainly used in passenger cars and special vehicles;

third, except for CATL, domestic power battery companies are still equipped with

domestic Mainly vehicle companies, there is still a gap compared with the scale

and influence of Japanese and Korean battery-equipped internationally renowned

brand cars.

Table 3 Power battery product types and applications of different

companies

Data source: Statistical analysis by the Policy Research Center of China

Automotive Technology and Research Center Co., Ltd.

3. The development path of power battery industrialization

With the engineering and commercial development of power battery products

along different technical routes, lithium-ion power battery technology is

gradually progressing towards higher energy density, cycle life and other

indicators. Among them, the positive electrode material is a high-nickel ternary

material, and nano-silicon is added to the negative electrode to form a

silicon-carbon negative electrode material. The electrolyte gradually develops

from liquid to solid to achieve higher lithium battery energy density products

and the industrialization of related market fields.

3.1 High nickel ternary cathode material

3.1.1 Technical principles, advantages and disadvantages

Nternary materials are currently the best choice for high-energy-density

power batteries. High-nickel ternary batteries are becoming the mainstream of

power battery applications in the short term. Ternary materials combine the

performance advantages of nickel (increase battery capacity), cobalt (increase

ion conductivity), and manganese (stable structure). They are the mainstream

products with high energy density, high performance and low cost in the recent

stage. By 2020, my country's industrialized energy density index for high-nickel

ternary lithium batteries will be 300Wh/kg, and we will strive to achieve

350Wh/kg.

High-nickel ternary materials still have certain technical shortcomings.

First, the nickel proportion of high-nickel ternary materials increases, which

intensifies the mixing of nickel and lithium ions, reducing the discharge

specific capacity; second, the phase change of nickel during the deintercalation

and removal of lithium causes volume changes, which reduces the structural

stability of the material, thereby leading to cycle The service life is reduced;

third, impurities such as lithium carbonate are more likely to form on

high-nickel cathode materials. High-temperature environments will cause

flatulence, and side reactions between impurities and electrolytes will

eventually lead to a decrease in cycle life; fourth, the increase in nickel

content generates heat, making the cathode The thermal stability of the material

decreases; fifth, the surface impurities of high-nickel ternary materials

increase, and the optimization of the electrolyte formula is still a difficult

problem.

3.1.2 R&D and industrialization, major R&D enterprises

Internationally, Panasonic, Samsung SDI, LG Chem and other companies have

achieved mass production of high-nickel ternary batteries (Panasonic

nickel-cobalt-aluminum ternary material batteries are equipped with Tesla

models, the ratio of nickel, cobalt and aluminum is 8:1.5:0.5, single The energy

density of the bulk cell is 300Wh/kg).

Domestically, companies are currently developing ternary material 622

system and 811 system technologies, but have not yet mass-produced them.

Industry leading companies such as CATL, BYD, Lishen, and Guoxuan Hi-Tech have

made progress in the research and development of high-nickel ternary lithium

batteries. The positive electrode materials of BYD, AVIC Lithium Battery, and

BAK batteries use high-nickel ternary materials, and the negative electrode

materials use nano-silicon material systems. The energy density is planned to be

increased to 300Wh/kg in 2020. CATL's high-energy-density batteries use a

high-nickel ternary/silicon carbon material system and plan to reach 300Wh/kg in

2020. The high-energy-density batteries of Guoxuan Hi-Tech, China Electric Power

Shen, and Yiwei Lithium Energy use high-nickel ternary positive electrode and

silicon-based negative electrode material systems, and plan to reach 300Wh/kg in

2020.

3.2 Silicon carbon anode material

3.2.1 Technical principles, advantages and disadvantages

The silicon-carbon negative electrode material formed by nano-silicon and

graphite can effectively increase the gram capacity of lithium batteries and

further achieve higher energy density. From the currently commercialized silicon

carbon anodeIn terms of material performance, compared with graphite anode

materials, the biggest advantage of silicon-carbon anode materials is the

increase in specific capacity. The lowest specific capacities of silicon-carbon

anode materials exceed the theoretical specific capacity of graphite anode

materials. The theoretical energy density of graphite is 372mAh/g, and the

theoretical energy density of silicon anode is as high as 4200mAh/g.

Despite this, silicon-carbon negative electrode materials still have

shortcomings. First, the volume of silicon expands by 100% to 300% during the

charge and discharge process, which affects the conductivity to a certain

extent. Second, silicon is a semiconductor, and its conductivity is different

from that of graphite. It is highly irreversible during the deintercalation

process of lithium ions, and the Coulombic efficiency decreases for the first

time.

3.2.2 R&D and industrialization, major R&D enterprises

Internationally, Tesla Model 3 uses a silicon-carbon negative electrode

power battery with a battery capacity of more than 550mAh/g and an energy

density of 300Wh/kg. The silicon-based anode lithium-ion battery developed by

Japan's GS Yuasa has been used in well-known brand cars such as Mitsubishi;

Hitachi Group Maxell has developed a high-capacity silicon anode lithium

battery.

Domestically, companies such as CATL, Guoxuan Hi-Tech, BYD, BAK, Lishen,

and AVIC Lithium Battery have made progress in the research and development of

silicon-carbon anode batteries. At the same time, domestic anode material

manufacturers have made plans in the field of silicon-carbon anodes. Companies

such as Beterui and Zichen have taken the lead in launching a variety of

silicon-carbon anode materials and have included them in the above-mentioned

power battery R&D system. Shanshan Energy has already introduced

silicon-carbon anode materials. carry out industrialization. New silicon-carbon

anode materials have become the main direction of product research and

development for battery and materials companies.

3.3 Solid electrolyte

3.3.1 Technical principles, advantages and disadvantages

A solid-state battery is a battery that uses solid electrodes and

electrolytes. Currently, it includes all-solid lithium batteries, lithium-air

batteries, etc. (metal lithium reacts reversibly with oxygen). All-solid-state

lithium battery is an innovative system of lithium batteries. First, the content

of industrial electrolytes in battery cells gradually decreases, and

solid-liquid mixed electrolytes gradually replace liquid electrolytes, and

eventually develop into all-solid electrolytes. Electrolytes mainly include two

categories, one is organic polymer solid electrolyte, and the other is inorganic

polymer solid electrolyte. The solid electrolyte is different from the

traditional electrolyte in the lithium battery industry. It has high ionic

conductivity, high ion migration number, good mechanical properties, good

thermal stability, and good compatibility.

Solid electrolytes are more stable than liquid electrolytes and the

electrode materials will not dissolve. More solid material electrolytes with

higher electrochemical stability are being studied. In the future, positive and

negative electrode materials are developing towards higher voltage and greater

current capacity density. But at the same time, the industrial development of

solid-state batteries has disadvantages such as high cost, low charging rate due

to impedance and conductivity, and excessive interface impedance between

electrodes and electrolytes.

3.3.2 R&D and industrialization, major R&D enterprises

Internationally, Toyota has a long history of research in the field of

solid-state batteries. Its lithium-sulfur system battery has successfully

applied for a patent in the United States. The biggest feature of this system is

its good thermal stability and safety, making it the most industrialized

technology route. . SolidPower uses lithium metal as the anode technology route

to develop products with higher energy density, and has launched industrial

cooperation with BMW. For this reason, companies such as Samsung SDI, Hyundai

Group, Hitachi Group, French Bolloré, and American Sakti3 are also making

progress in independent research and development of solid-state batteries,

striving to achieve early industrialization.

Domestically, the Ningbo Institute of Technology is focusing on lithium

metal anodes and lithium-sulfur systems to research high-safety, high-rate

solid-state batteries with different electrolyte systems. 【】 Qingdao Institute

of Energy and Process Research proposed an ion-conducting polymer system, which

is composed of polymers and lithium salts. This system significantly improves

the mechanical strength of the structure. In addition, domestic companies such

as CATL, China Electric Power Shen, Ganfeng Lithium, and Guoneng Battery have

carried out R&D and manufacturing process research on high energy density

solid-state batteries above 400Wh/kg. The industrialization of solid-state

batteries to replace current lithium batteries is gradually accelerating.

4 Conclusion

This article analyzes the development status of my country's lithium-ion

power battery industrialization in detail from the aspects of industry, market,

technology, etc., analyzes the development trend of my country's power battery

industrialization from the industrial and technical perspectives, and discusses

the industrial structure and development of my country's power batteries.

Quality, technology research and development, international development and

other aspects, and finally pointed out the path for the industrialization

development of my country's cr2032 3v lithium battery. my country's power

battery market demand is huge, but industry competition is becoming increasingly

fierce, industry reshuffle and integration are ongoing, and the market will

further concentrate on advantageous companies. In the process of

industrialization development, the main body of the power battery industry must

put product performance and safety first, and continuously strengthen the

construction of new material system power battery research and development and

manufacturing process innovation capabilities. Only with sufficient product

research and development strength and large-scale production capabilities, Only

those who grasp the direction of industrialization development will remain

invincible in future competition.

Read recommendations:

Coin Battery CR 1130

18650 li ion rechargeable battery.18650 lithium-ion battery pack production process

What should I pay attention to when using lithium battery in RV

lithium-ion battery pack

18650 battery pack sales

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP