The dispute over the technical route of power 9v alkaline battery has arisen again

Wotma used to be the leader of lithium iron phosphate power batteries. Its focus on lithium iron phosphate has made Watma the forefront of the industry in terms of technology. However, at the time of Watma's large-scale expansion and policy changes in the new energy vehicle industry, Watma fell into a capital turnover dilemma and was entangled.

Recently, Watma's parent company, Jianrui Woneng, announced that it would introduce a partner, Jiangsu Huakong Investment Management Co., Ltd., to revitalize Watma's subsidiary Hunan Watma and help it resume production. However, Jiangsu Huakong's entry is not to value the application of lithium iron phosphate as a power battery, but to hope that Hunan Watma's production capacity will gain in the energy storage market.

Due to the low energy density of lithium iron phosphate batteries, the technical route dispute between lithium iron phosphate and ternary materials has never stopped. Does the change in investors' views on lithium iron phosphate mean that lithium iron phosphate will fail in power batteries? In fact, the reporter noticed that with the approaching of the withdrawal of subsidies for new energy vehicles, some securities firms have begun to be optimistic about the investment prospects of lithium iron phosphate.

Is Wotema back to life?

Jinrui Woneng, which is in deep crisis, has a ray of hope. Jinrui Woneng recently announced that in order to help Hunan Wotema, a subsidiary of its wholly-owned subsidiary Wotema, resume production, the company signed an "Investment Cooperation Framework Agreement" with Jiangsu Huakong, and plans to jointly initiate the establishment of a joint venture. Affected by this news, Jinrui Woneng's stock price rose to the daily limit on April 19.

According to the agreement, Jinrui Woneng and Jiangsu Huakong plan to jointly invest in the establishment of Hunan Anding New Energy Co., Ltd. (hereinafter referred to as Anding New Energy). The registered capital of the joint venture is 200 million yuan, and Jinrui Woneng or its designated third party intends to subscribe to a capital contribution of 110 million yuan, accounting for 55% of the registered capital, and Jiangsu Huakong or a third party under its control intends to subscribe to a capital contribution of 90 million yuan, accounting for 45% of the registered capital.

The establishment of a joint venture is seen as a self-rescue move by Jinrui Woneng. Since Wotema, Jinrui Woneng has repeatedly saved itself. In February last year, Jinrui Woneng disclosed a framework agreement with Jiayi Precision on issuing shares to pay cash to purchase assets, as well as a cooperation framework agreement with Altura Mining Limited. However, in the end, due to Jinrui Woneng's termination of planning major asset restructuring, these two framework agreements were also terminated accordingly.

In addition, Jinrui Woneng also disclosed the partnership agreement of Shaanxi Litong No. 1 New Energy Partnership (Limited Partnership) in October last year to introduce strategic investors. At present, the partnership has completed the industrial and commercial registration procedures and obtained a business license, and the partners' funds have been in place for 23.5 million yuan.

Of course, signing the framework agreement is only the first step. After that, Jinrui Woneng and Jiangsu Huakong will jointly negotiate investment cooperation related matters with the local government. On the premise of obtaining government approval and consent, the two parties will sign a formal investment cooperation agreement and quickly promote the implementation of company registration, capital implementation, plant and equipment and other related matters after fulfilling their respective approval procedures.

Industrial and commercial information shows that Jiangsu Huakong's shareholders include Lu Zhongyi and Hua Jun, who hold 70% and 30% of the shares respectively. Lu Zhongyi also serves as the chairman of Jiangsu Huakong. Jiangsu Huakong raised funds in Nanjing in July 2008 to establish a company-based RMB venture capital fund, Jiangsu Huakong Venture Capital Co., Ltd., with a registered capital of 200 million yuan.

Lu Zhongyi said in an interview with e-company reporters that the cooperation between the two parties will be carried out in the form of cash investment to ensure the normal production and operation of the joint venture. He told reporters that the joint venture will still use Hunan Wotema's existing factory buildings and equipment for production, but the joint venture is a clean new company and will not be involved in Wotema's disputes.

In the announcement, Jianrui Woneng disclosed that Jiangsu Huakong has a strategic partnership with many well-known investment institutions at home and abroad, and the company's strength and operational capabilities are outstanding. Lu Zhongyi told reporters that Jiangsu Huakong had previously invested in new energy and lithium battery-related projects.

Judging from the stock price, the market has responded to Jianrui Woneng's self-rescue behavior. Jianrui Woneng said that due to the large-scale expectations of Wattma, production and operation were severely affected, and the orders on hand could not be executed normally. Although the company actively saved itself, the relevant rescue work at the Wattma level was progressing slowly. The establishment of a joint venture would help the company resume production.

The battle over the power battery route has re-emerged

"If it was a year ago, we would not pay attention to the direction of lithium iron phosphate, because its energy density is relatively low, and it cannot compete with ternary batteries when used as a power battery." Lu Zhongyi told reporters that the cooperation with Wattma was due to seeing the explosion of lithium iron phosphate batteries in the energy storage market. "The cost of lithium iron phosphate is relatively low, and the business model for using it in energy storage is feasible."

Lu Zhongyi told reporters, "We predict that lithium iron phosphate will have a large number of applications in energy storage. If used for energy storage, a 40-inch standard container can hold about 2MWh of lithium iron phosphate batteries, which does not require a lot of space."

From this point of view, will the application of lithium iron phosphate in power batteries really decline? The battle over the technical route of power batteries has been going on for a long time. Lithium iron phosphate does not have much competitive advantage in small vehicles such as passenger cars. On large vehicles such as buses and logistics vehicles, although the requirements for battery volume and quality have been relaxed, the industry is also worried that the growth space of this market is limited.

However, the reporter noticed that the market has recently begun to increase its optimism about the application of lithium iron phosphate in the field of power batteries. For example, Orient Securities pointed out that this year's new energy vehicle subsidy policy and industrial development direction will be adjusted, and plug-in hybrid models and some low-end pure electric models will switch to lithium iron phosphate batteries, and the recovery of lithium iron phosphate is imminent.

Specifically, the current energy density of lithium iron phosphate battery system can reach 140Wh/Kg, and the cost is 10%-15% cheaper than ternary batteries. Low-end models can save 3,000-6,000 yuan by replacing lithium iron phosphate batteries. Recently, two models, the BAIC New Energy EC220 standard version and the JAC iEV7L, have adopted lithium iron phosphate batteries. In addition, the 2019 facelift of the two plug-in hybrid models will also use lithium iron phosphate.

Dongfang Securities previously estimated that the installed capacity of lithium iron phosphate batteries this year will be 24.24GWh, a figure obtained by the fact that lithium iron phosphate accounts for 5% of passenger cars; however, considering that some passenger car battery matching has shifted from ternary to lithium iron phosphate, this shift will drive the installed capacity of lithium iron phosphate batteries to increase by 13.26GWh. On the whole, the installed capacity of lithium iron phosphate batteries this year will increase by 73.85% year-on-year.

However, according to the data of Truth Research, in the first quarter of this year, the total installed capacity of power batteries reached 12.57GWh, a year-on-year increase of 180%, of which the installed capacity of lithium iron phosphate batteries was 2.94GWh, accounting for 23.34%. Compared with the same period last year, the installed capacity of lithium iron phosphate batteries increased by 125%, but the market share fell by 6 percentage points.

From the perspective of market share, there was no sign of recovery of lithium iron phosphate batteries in the first quarter of this year. What is the reason? Orient Securities believes that the supporting advantages of lithium iron phosphate batteries in passenger cars will not be reflected until the transition period of new energy vehicle subsidy withdrawal ends. By then, as more models replace lithium iron phosphate batteries and enter the market, their installed share will increase.

Let's take a look at ternary batteries. In the first batch of new energy vehicle promotion catalogs in 2019, CATL's ternary battery energy density reached a new high of 182.44Wh/Kg, while in the existing 13 batches of promotion catalogs, the highest energy density of lithium iron phosphate batteries is 153.59Wh/Kg, the former is nearly 20% higher than the latter.

The reporter learned that in the recent batches of new energy vehicle promotion catalogs, the signs of ternary batteries and lithium iron phosphate batteries dividing the market segments have become increasingly clear. Among them, ternary batteries with higher energy density further cover the passenger car market with higher endurance requirements, while lithium iron phosphate batteries with lower energy density cover the bus market and some special models with higher safety and cost requirements.

Read recommendations:

R03P

Lithium battery manufacturers introduce three categories of lithium batteries!lifepo4 lithium ion ba

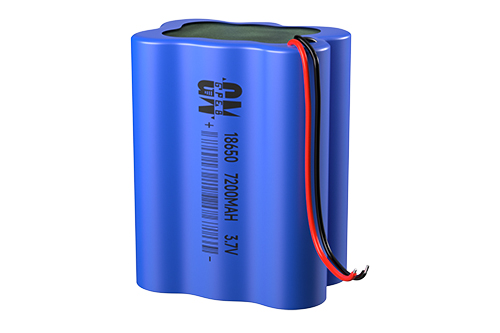

3.7v 2200mah 18650 lithium battery.Differences in 18650 lithium battery types

12v 300ah lifepo4 battery pack

li ion 18650 battery pack maker

360° FACTORY VR TOUR

360° FACTORY VR TOUR

Whatsapp

Whatsapp

Tel

Tel Email

Email TOP

TOP